A Payment System That Always Has a Path Forward

Customers want your service. They just need a way to pay that works.

Some customers:

Can pay in full

Qualify for financing

Qualify for part of it

Don’t qualify at all

Most systems only support one of these scenarios. FinanceMutual™ supports all of them.

One System. Four Ways to Pay.

FinanceMutual™ adapts automatically based on customer eligibility.

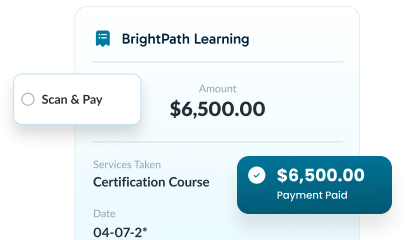

One-Time Payment

Customers who want to pay upfront can do so instantly.

Full Financing

If approved, 100% of the amount is financed.

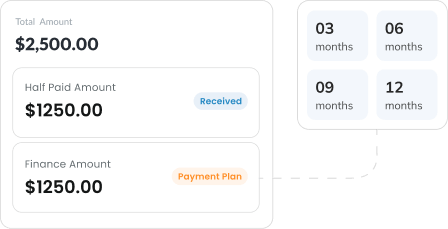

Partial Financing + Payment Plan

Finance what’s approved. Put the rest on a structured payment plan.

No Approval → Full Payment Plan

If financing isn’t approved, the full amount moves to a protected payment plan.

Regardless of credit or approval, your customers can always proceed.

Beyond Financing or BNPL.

We Provide a Payment Infrastructure.

You are not lending money

You are not funding payments

You are not taking credit risk

We provide the structure, protection, and visibility so payments work in the real world — not just on approval.

Achieve Remarkable Results with FinanceMutual™

-

Close more deals

-

Increase average ticket size

-

Eliminate awkward payment conversations

-

Stop losing customers after financing denial

-

Create predictable, structured payments

Built for Businesses That Can’t Afford Lost Deals

FinanceMutual™ works especially well for:

Healthcare & dental practices

Home services & contractors

Professional services

Retail & high-ticket sales

Any business where customers want flexibility

If payment friction costs you deals, FinanceMutual™ fixes that.

Achieve What You’ve Always Envisioned

The Proof Is in the Progress: How We’re Fueling Growth for Businesses

Smarter Financing That Gave Us the Edge

“Now every customer has an option — and our close rate jumped.”

Sarah W.

A True Partner in Our Growth Journey

“We stopped losing customers the moment financing said no.”

John M.

A Game-Changer for Our Cash Flow

“This replaced multiple payment tools with one system.”

Laura T.

See How It Works for Your Business

In a 15-minute walkthrough, we’ll:

- Apply FinanceMutual™ to your real ticket sizes

- Show all four payment paths live

- Identify where you’re losing revenue today

You’ve Built Something Worth Choosing Now Make Paying for It Effortless