Practina

A full-stack AI marketing operating system to help you attract more customers.

2025 Was BIG.

But 2026 Will Be UNSTOPPABLE!

Welcome to a New Year of Faster Cash Flow, Stronger Tools & Smarter Financing.

We’ve spent 2025 powering your business with smarter, AI-driven payment plans built to suit each customer’s unique financial reality. In 2026, we’ll be taking it several steps further with new automation capabilities and fresh integrations.

2025 Highlights:

The Year FinanceMutual Leveled Up

Here’s your quick snapshot of what we achieved together:

We Helped Businesses

Serve More Customers

Than Ever

With smarter AI-powered insights and personalized plan recommendations, conversion rates soared across industries.

Transparent Transaction

Fees Rolled Out

No confusion, no hidden charges. Transaction fees are displayed with clarity that builds trust and boosts conversions.

Automated Dispute

Handling Went Live

FinanceMutual’s new system tracks disputes, lets you upload documents directly, and provides clear status updates.

The New Driver’s License

Scanning Feature

Launched

Customers can scan their U.S. Driver’s License via a secure link to fill in key contract details. Onboarding is now smoother, faster, and 3x more efficient.

Many New Businesses

Secured Predictable

Monthly Revenue

From healthcare to wellness to automotive, many businesses joined us to serve customers with AI-powered payment plans and scaled new heights.

We Introduced the

FinanceMutual Customer

App

A clean, intuitive app that leds to fewer disputes, more on-time payments, higher customer satisfaction, and easy bank-pay savings highlights.

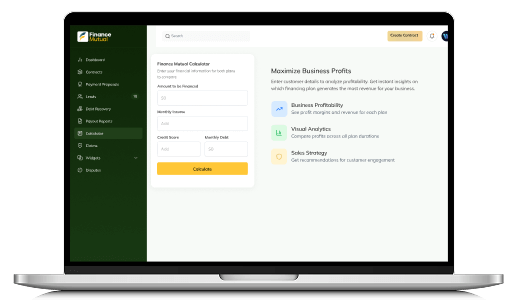

Meet Your New Payment Plan Calculator — Fast, Smart, Effortless

A faster, smarter way to estimate payment plans, before creating a contract.

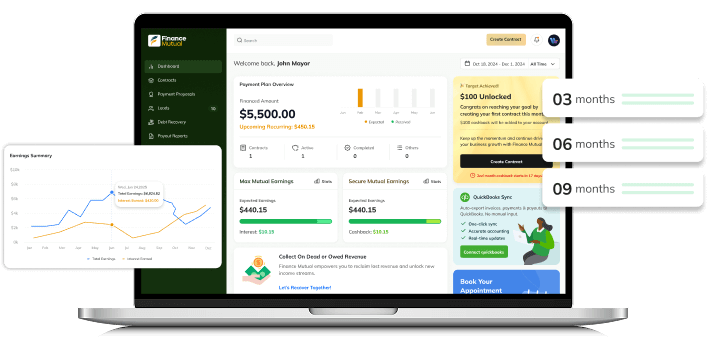

Now available inside your Business Panel, the new Payment Plan Calculator helps you instantly preview estimated Max Mutual and Secure Mutual financing scenarios based on your customer’s basic financial information.

With the FM Calculator, you can:

Powerful Integrations to Supercharge Your 2026 Growth

We’ve integrated top-tier solutions to create a financing environment that does more than process payments — it helps you grow.

Practina

A full-stack AI marketing operating system to help you attract more customers.

CoolCredit

An AI-powered credit boost & repair tool that increases customer eligibility.

QuickBooks

Industry-leading accounting integration for seamless financial syncing.

Recuvery

A debt-collection solution that protects relationships and recovers revenue.

Together, these integrations supercharge your workflow, enhance cash flow, and complement FinanceMutual’s AI-powered payment plans, helping your business thrive in 2026.

Blog Feature:

Insider Insights for Healthcare Growth

Gain access to proven retention strategies that top practices use to keep patients coming back, improve satisfaction, and drive steady revenue.

As we step into the new year, we want to extend our gratitude for letting FinanceMutual be part of your business journey. Here’s to a year full of growth, smoother cash flow, smarter payments, and more successes than ever!

Copyright © FinanceMutual™. All rights reserved.

We value your privacy

We use cookies and similar technologies to help our site function, to understand how it's used, and to tailor advertising. You can accept all cookies or customize your settings below.

When you visit our website, it may store or retrieve information on your browser, mostly in the form of cookies. This information might be about you, your preferences, or your device and is mostly used to make the site work as you expect it to. The information does not usually directly identify you, but it can give you a more personalized experience.

Because we respect your right to privacy, you can choose not to allow some types of cookies. Click on the different category headings below to find out more and manage your preferences. Please note, blocking some types of cookies may impact your experience of the site and the services we are able to offer

These cookies are necessary for the website to function and cannot be switched off in our systems. They are usually only set in response to actions made by you which amount to a request for services, such as setting your privacy preferences, logging in, or filling in forms. You can set your browser to block or alert you about these cookies, but some parts of the site will not then work. These cookies do not store any personally identifiable information.

These cookies allow us to count visits and traffic sources so we can measure and improve the performance of our site. They help us to know which pages are the most and least popular and see how visitors move around the site. All information these cookies collect is aggregated and therefore anonymous. If you do not allow these cookies, we will not know when you have visited our site and will not be able to monitor its performance.

These cookies enable the website to provide enhanced functionality and personalisation. They may be set by us or by third-party providers whose services we have added to our pages. If you do not allow these cookies then some or all of these services may not function properly.

These cookies are used to make advertising messages more relevant to you and may be set through our site by us or by our advertising partners. They may be used to build a profile of your interests and show you relevant advertising on our site or on other sites. They do not store directly personal information, but are based on uniquely identifying your browser and internet device.