Here’s How

FinanceMutual Just

Got Better for Your Business

Your Inside Look at This Quarter’s Biggest Updates

Last time, we introduced Driver’s License Scanning and gave you a sneak peek at our Customer App. This time, we’re taking another big step forward—with updates designed to make payments smoother, more transparent, and more secure for your business.

Key Update:

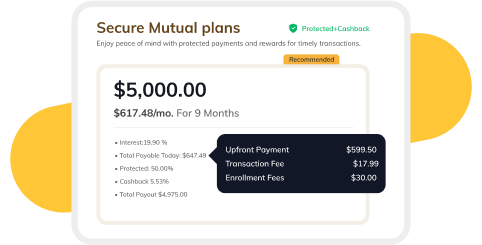

Smarter, Fairer Transaction Fees

No one likes hidden costs. That’s why transaction fees across FinanceMutual payment plans are now transparent and easy to understand.

What’s new?

ACH (Bank Transfer) is now cheaper

Only $2 or 1.9% per payment.

Cards (Credit/Debit)

$3 or 3% of the payment amount.

No surprises

All amounts (recurring, today’s payment, payoff) are now shown, including fees, so there’s no confusion.

ACH savings highlighted

See how much your customers save with bank payments (e.g., “Customer saves $35.52 over the contract with Bank Payments”).

Why this matters for your business:

Encourages more customers to pay via bank transfer, resulting in lower costs for everyone.

Transparent pricing builds trust and fewer disputes.

Easy to explain since savings are shown directly on contracts and proposals.

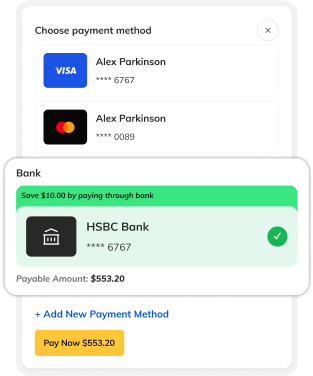

The Customer Panel Just Got Smarter

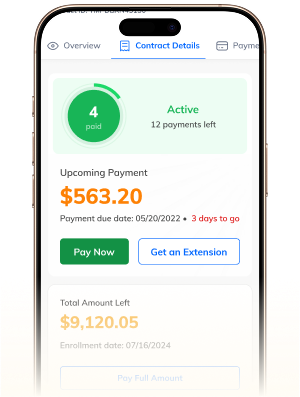

Your customers now see payments the way they should — simple and transparent. All upcoming payments are shown with the transaction fees already included, so there are no hidden surprises.

When customers choose bank transfers, the panel highlights how much they save.

The result? More customers pick the lower-cost method, your business spends less on fees, and everyone feels confident about what they’re paying.

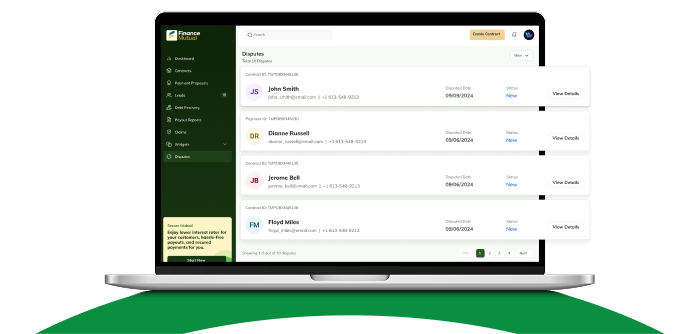

Introducing Our New Dispute Handling System

Payment disputes can be stressful. We’ve built a streamlined dispute resolution system to ensure transparency, timely resolution, and seamless document workflow. Faster resolutions mean you can focus on growing your business instead of chasing disputes.

Key features:

Dispute tab (visible only if a dispute exists) → clear status updates like New, Pending, Submitted, Verified.

Upload & track documents right from your panel.

Admin reviews & requests more info if needed, with email/in-app notifications.

Outcome handling → if you win, funds are returned; if lost, clear recordkeeping ensures no confusion.

Here’s how this process works:

1. Dispute Raised

Customer files a dispute → flagged in Business Panel.

2. Notification

You receive an alert with contract details + dispute fee.

3. Document Submission

Upload supporting documents in the panel (re-upload if required).

6. Case Closed

Status updated → full log maintained.

5. Decision

4. Admin Review

Team verifies submitted documents.

Now Live: The Customer App That Simplifies Everything

If you haven’t introduced your customers to the FinanceMutual app yet, now’s the time. The app gives your customers a simple way to:

Track in Real Time

Customers get a clear view of their payment plans anytime.

Pay Anywhere

Secure payments anytime, anywhere with just a few taps.

Stay Ahead

Upcoming payments are shown upfront with fees included.

See Savings Clearly

Clear savings are highlighted when choosing bank transfers.

Download our app!

Blog Spotlight

Customer Financing Solutions:

A Complete Guide

Not sure how to best set up financing for your customers? Our latest guide breaks it all down step by step.

Wrapping Up!

We’re here to help you get paid faster, cut costs, and keep customers happy. And this is just the start. More enhancements are on the way!

Stay Tuned!

Copyright © FinanceMutual™. All rights reserved.